- 7.1 Components of a Proper Application

- 7.2 Structuring the Application

- 8.1 What is a NOC from a bank?

- 8.2 Why do I need a NOC from my bank?

- 8.3 How can I apply for a NOC from my bank?

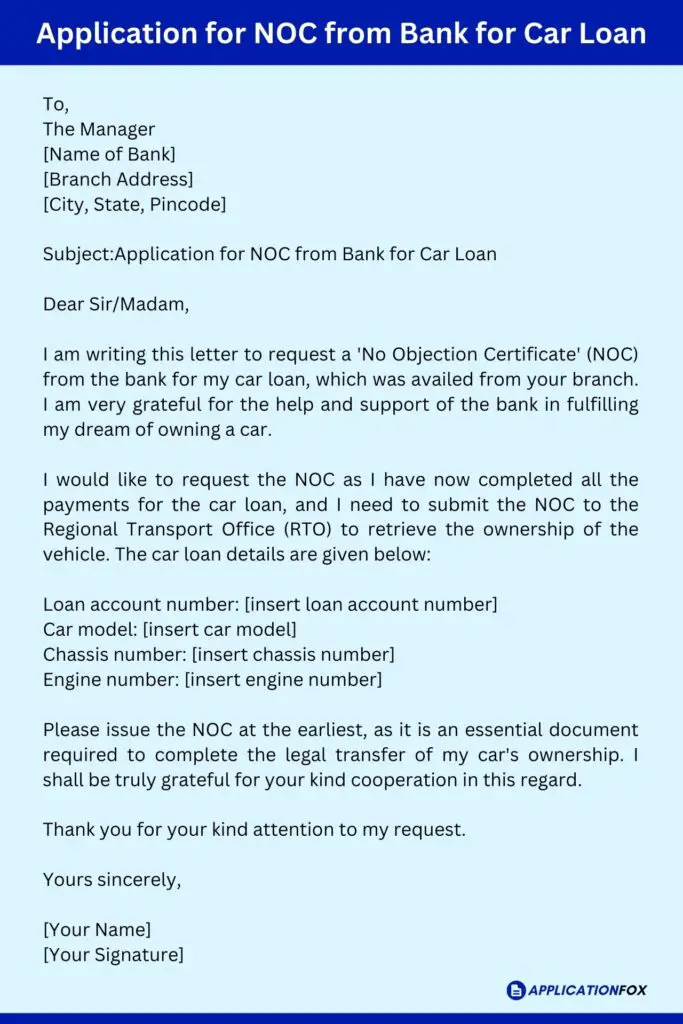

Letter Application for NOC from Bank for Car Loan

To,

The Manager

[Name of Bank]

[Branch Address]

[City, State, Pincode]

Subject: Application for NOC from Bank for Car Loan

I am writing this letter to request a ‘No Objection Certificate’ (NOC) from the bank for my car loan, which was availed from your branch. I am very grateful for the help and support of the bank in fulfilling my dream of owning a car.

I would like to request the NOC as I have now completed all the payments for the car loan, and I need to submit the NOC to the Regional Transport Office (RTO) to retrieve the ownership of the vehicle. The car loan details are given below:

Loan account number: [insert loan account number]

Car model: [insert car model]

Chassis number: [insert chassis number]

Engine number: [insert engine number]

Please issue the NOC at the earliest, as it is an essential document required to complete the legal transfer of my car’s ownership. I shall be truly grateful for your kind cooperation in this regard.

Thank you for your kind attention to my request.

[Your Name]

[Your Signature]

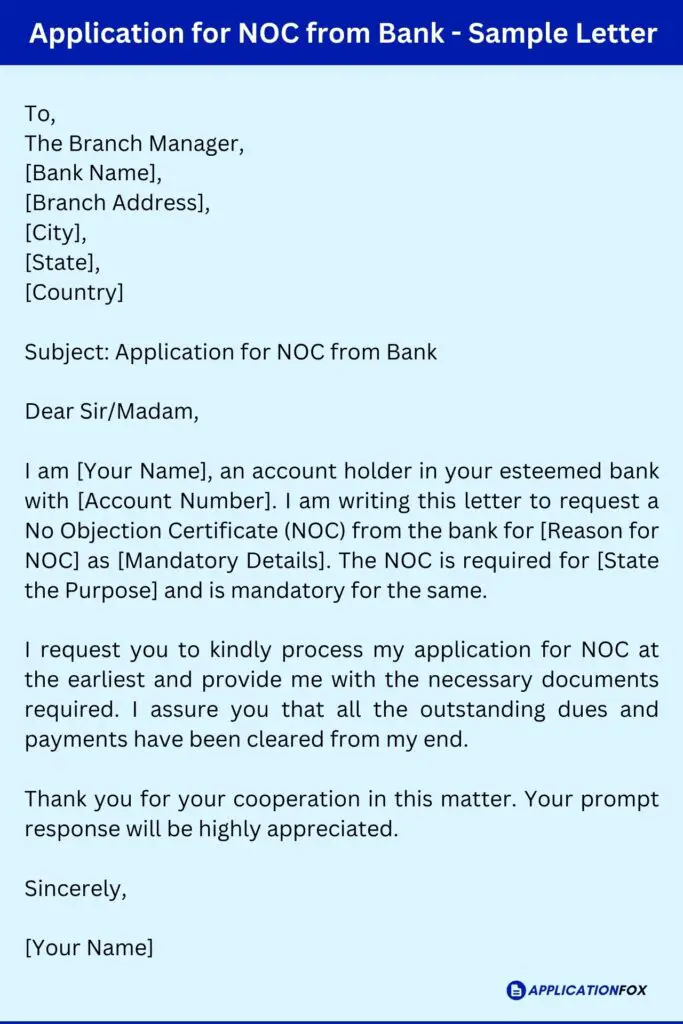

Application for NOC from Bank – Sample Letter

To,

The Branch Manager,

[Bank Name],

[Branch Address],

[City],

[State],

[Country]

Subject: Application for NOC from Bank

I am [Your Name], an account holder in your esteemed bank with [Account Number]. I am writing this letter to request a No Objection Certificate (NOC) from the bank for [Reason for NOC] as [Mandatory Details]. The NOC is required for [State the Purpose] and is mandatory for the same.

I request you to kindly process my application for NOC at the earliest and provide me with the necessary documents required. I assure you that all the outstanding dues and payments have been cleared from my end.

Thank you for your cooperation in this matter. Your prompt response will be highly appreciated.

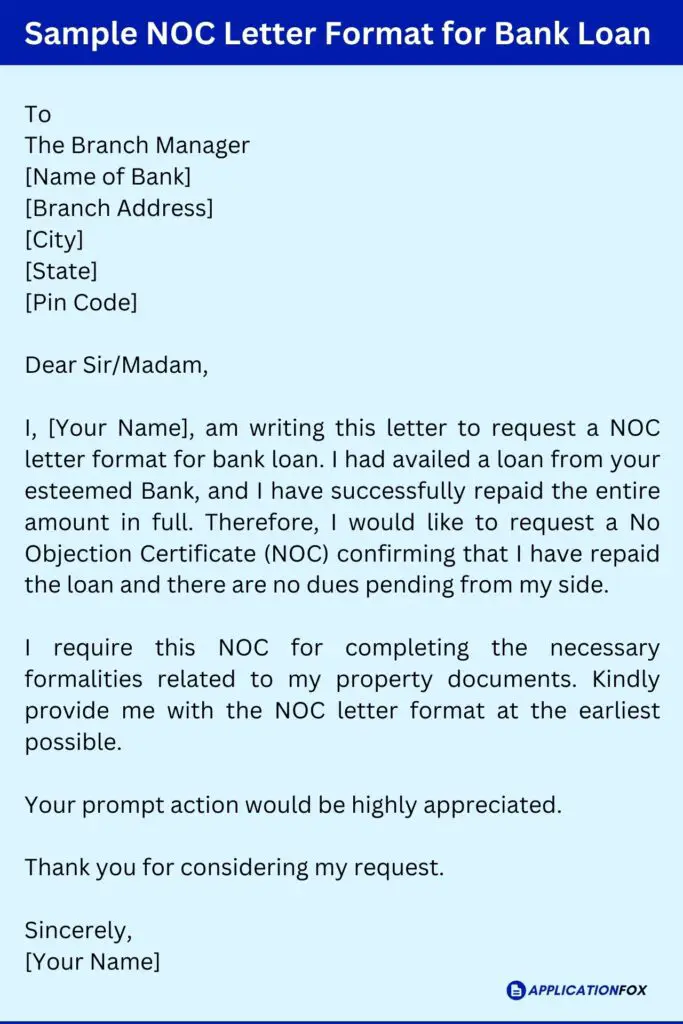

Sample NOC Letter Format for Bank Loan

To

The Branch Manager

[Name of Bank]

[Branch Address]

[City]

[State]

[Pin Code]

I, [Your Name], am writing this letter to request a NOC letter format for bank loan. I had availed a loan from your esteemed Bank, and I have successfully repaid the entire amount in full. Therefore, I would like to request a No Objection Certificate (NOC) confirming that I have repaid the loan and there are no dues pending from my side.

I require this NOC for completing the necessary formalities related to my property documents. Kindly provide me with the NOC letter format at the earliest possible.

Your prompt action would be highly appreciated.

Thank you for considering my request.

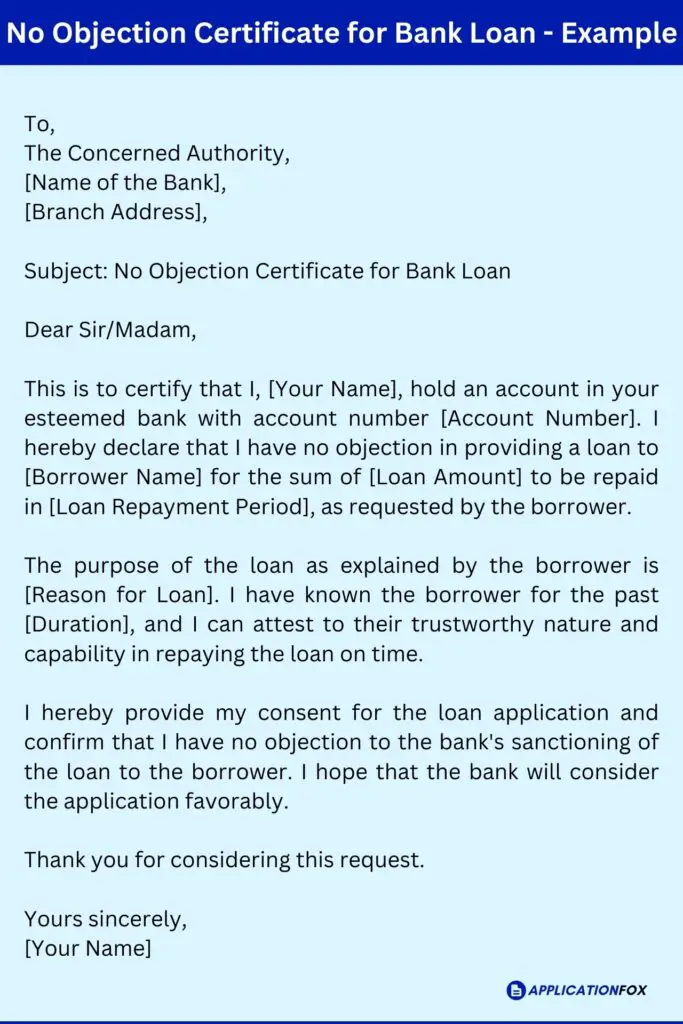

No Objection Certificate for Bank Loan – Example

To,

The Concerned Authority,

[Name of the Bank],

[Branch Address],

Subject: No Objection Certificate for Bank Loan

This is to certify that I, [Your Name], hold an account in your esteemed bank with account number [Account Number]. I hereby declare that I have no objection in providing a loan to [Borrower Name] for the sum of [Loan Amount] to be repaid in [Loan Repayment Period], as requested by the borrower.

The purpose of the loan as explained by the borrower is [Reason for Loan]. I have known the borrower for the past [Duration], and I can attest to their trustworthy nature and capability in repaying the loan on time.

I hereby provide my consent for the loan application and confirm that I have no objection to the bank’s sanctioning of the loan to the borrower. I hope that the bank will consider the application favorably.

Thank you for considering this request.

Yours sincerely,

[Your Name]

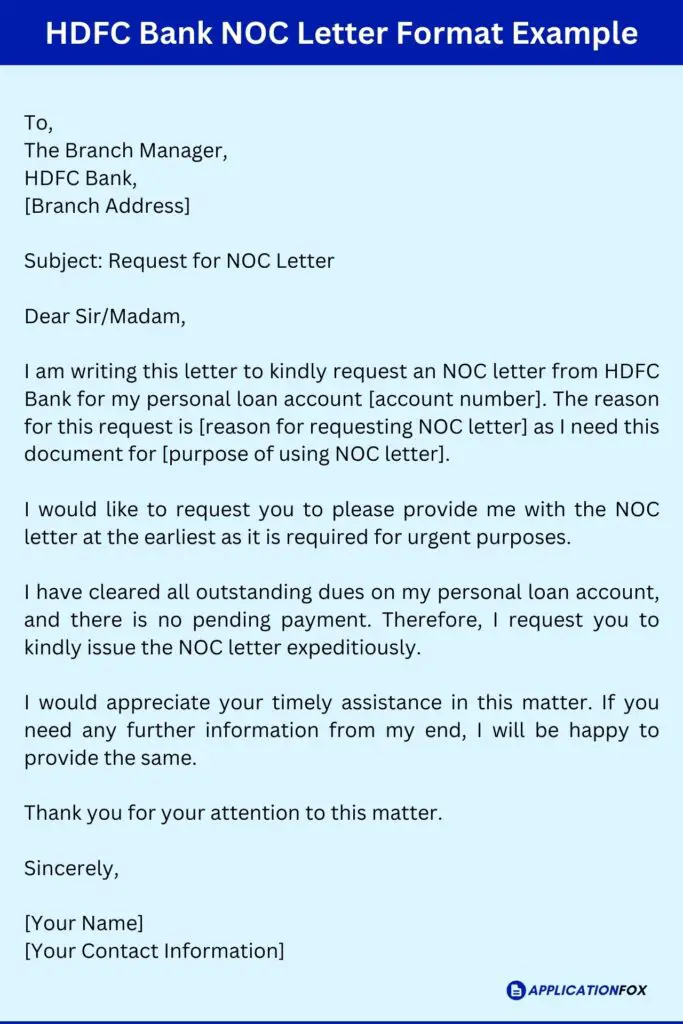

HDFC Bank NOC Letter Format Example

To,

The Branch Manager,

HDFC Bank,

[Branch Address]

Subject: Request for NOC Letter

I am writing this letter to kindly request an NOC letter from HDFC Bank for my personal loan account [account number]. The reason for this request is [reason for requesting NOC letter] as I need this document for [purpose of using NOC letter].

I would like to request you to please provide me with the NOC letter at the earliest as it is required for urgent purposes.

I have cleared all outstanding dues on my personal loan account, and there is no pending payment. Therefore, I request you to kindly issue the NOC letter expeditiously.

I would appreciate your timely assistance in this matter. If you need any further information from my end, I will be happy to provide the same.

Thank you for your attention to this matter.

[Your Name]

[Your Contact Information]

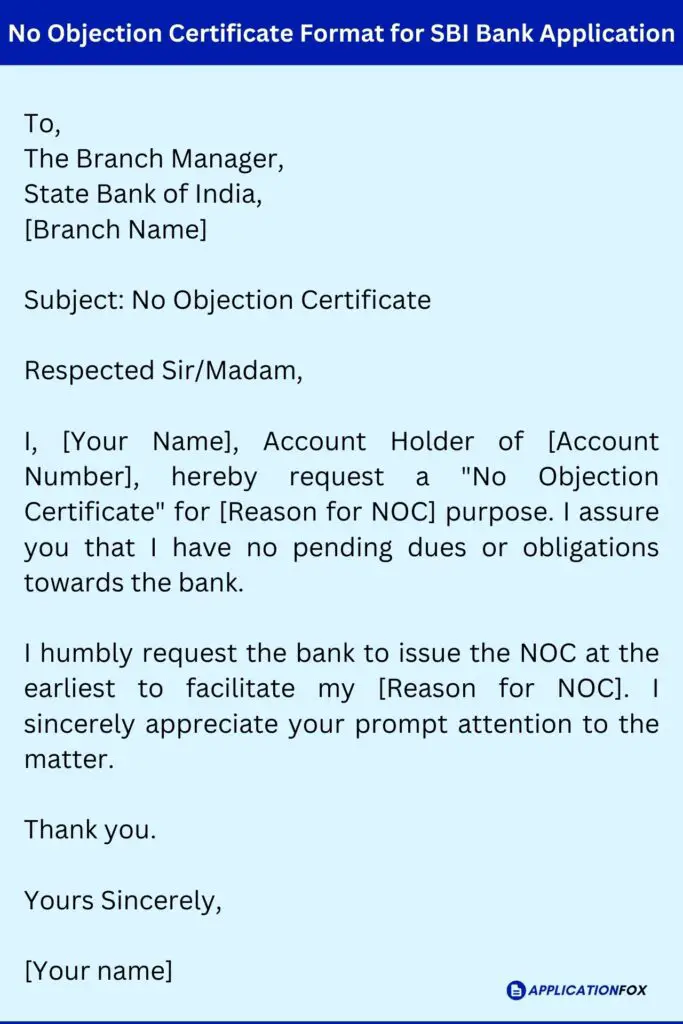

No Objection Certificate Format for SBI Bank Application

The Branch Manager,

State Bank of India,

[Branch Name]

Subject: No Objection Certificate

I, [Your Name], Account Holder of [Account Number], hereby request a “No Objection Certificate” for [Reason for NOC] purpose. I assure you that I have no pending dues or obligations towards the bank.

I humbly request the bank to issue the NOC at the earliest to facilitate my [Reason for NOC]. I sincerely appreciate your prompt attention to the matter.

Application for NOC from Bank Format: Things to Consider

When applying for a No Objection Certificate (NOC) from a bank in India, it is essential to ensure that your application includes all the necessary components. This will help to increase your chances of obtaining the NOC successfully and without any delay. In this section, we will discuss the necessary components of a proper application for NOC from a bank and how you should structure your application.

Components of a Proper Application

- Personal Information of the Applicant: The first component of an NOC application should include personal information such as your name, contact details, and identification information such as Aadhar card, PAN card, or passport number.

- Details of the Loan or Credit Facility: The second component of the application should include the details of the loan or credit facility taken from the bank. This includes information such as the loan account number, the date of disbursal, and the amount of the loan.

- Reasons for Requesting NOC: The third component of the application should state the reasons for requesting the NOC. It could be that the loan has been fully paid off or has been prepaid, or you may be transferring the loan to another bank.

- Declaration that Dues are Paid: The fourth component of the application must include a declaration from the applicant that they have paid off all dues and do not have any outstanding balance or obligation towards the bank.

- Other Necessary Details: Lastly, the application should include any other necessary details required by the bank to process the NOC request.

Structuring the Application

When applying for an NOC from a bank, you must structure your application in a clear and concise manner. The bank employees who process your application need to be able to quickly and easily understand the information you are providing. To structure your application, follow these three simple steps:

- Start with an Introduction: Begin the application with a brief introduction that states the purpose of the application and lists the components you will cover.

- Use Bullet Points or Numbered Lists: Organize and structure your application using bullet points or numbered lists. This will help to make the information easy to read and understand.

- End with a Conclusion: Finally, end the application with a conclusion that summarizes the purpose of the application, and ensures that the applicant has included all necessary information.

By following these simple steps when structuring your application, you can ensure that it is clear, concise, and easy to understand for the bank officials who will process it. A well-structured and comprehensive application will increase your chances of obtaining the NOC successfully and without delay.

FAQs

What is a NOC from a bank?

A No-Objection Certificate (NOC) from a bank is a document confirming that the bank has no objection to an individual or company’s financial activities in another country or institution.

Why do I need a NOC from my bank?

You might need a NOC from your bank to ensure compliance when conducting financial transactions outside of your home country, such as opening a new bank account, or in some cases getting a visa to travel.

How can I apply for a NOC from my bank?

The process varies between banks, but generally, you’ll need to submit a request letter detailing why you need the NOC and account statements or other documents proving your financial activity.

Related posts:

- Application for Closing Bank Account – 10+ Samples, Formatting Tips, and FAQs

- Bank Passbook Missing Letter – 8+ Samples, Formatting Tips, and FAQs

- Application for Mobile Number Registration in Bank – 6+ Samples, Formatting Tips, and FAQs

- Application for Changing Signature in Bank – 5+ Samples, Formatting Tips, and FAQs

- Application for Name Change in Bank Account – 11+ Samples, Formatting Tips, and FAQs

- Application for Unblock Atm Card – 3+ Samples, Formatting Tips, and FAQs